Reports out today that Trump and China (may) have a deal.

https://www.nytimes.com/2019/10/11/business/economy/us-china-trade-deal.html

A little hard to find details. Apparently this is “Phase One”, where the only thing agreed upon is China is going to buy some more food from the US and promise not to devalue their currency.

All in exchange for a promise not to raise tariffs (again).

Not a bad deal.

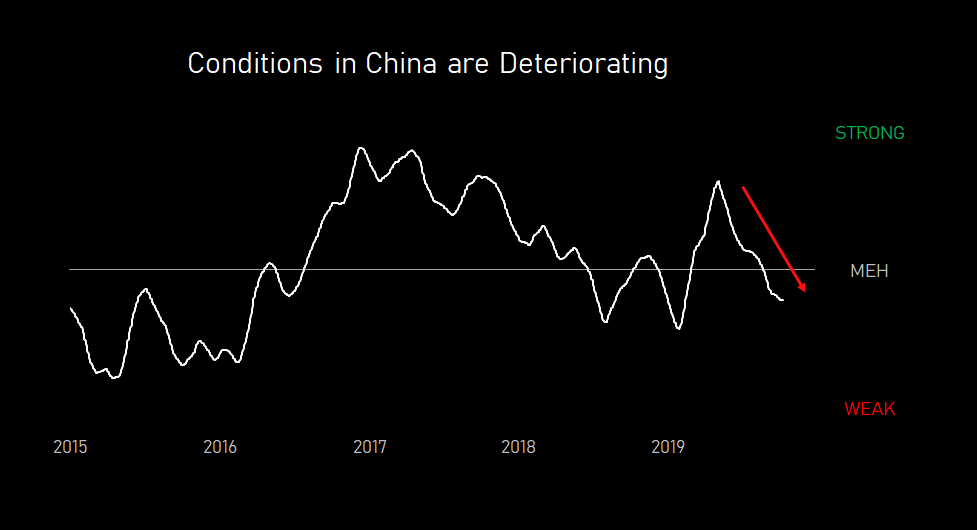

Thing is, by our measures, conditions in China are deteriorating.

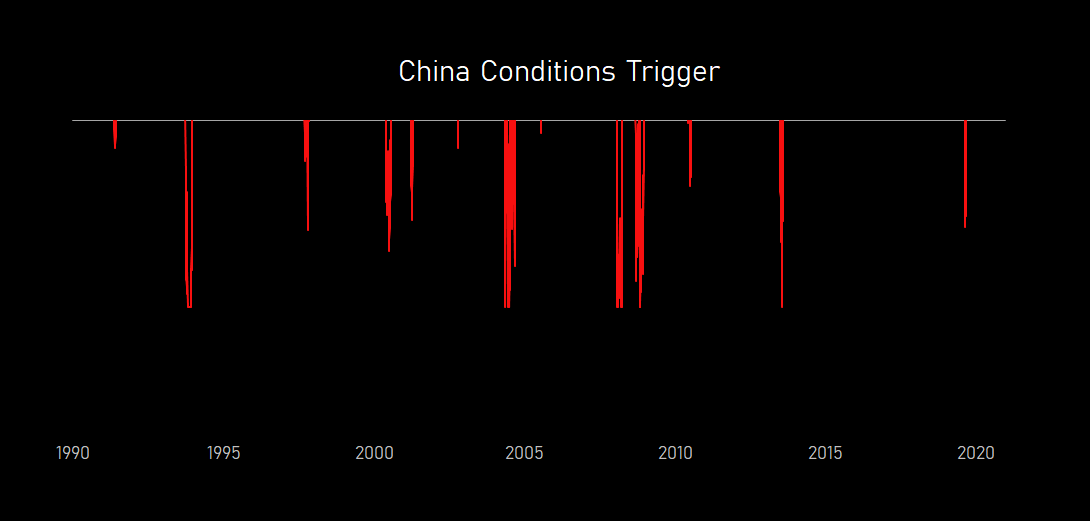

Say what you will about home-brew indicators, but looking back, we’ve only seen things deteriorate this fast over 6m a handful of times since 1990:

Which might make you wonder, how are things deteriorating, and why?

When we break that conditions indicator into pieces, we get a story. One that jibes with our understanding of what’s been happening.

If you only focused on activity, then you’d think conditions in China weakened starting in the middle of last year, and pretty much been weak ever since.

What looked like strength in the beginning of last year, was the flow through from easier policy, and higher prices for commodities and financial assets.

As that stimulation has rolled off, and turned to tightness, so has strength in the prices financial assets and commodities.

Meaning, it looks like the Chinese policy easing passed through entirely to better conditions in prices in the financial sector, with little to no impact on real economic activity.

So why hasn’t real economic activity responded to the dual shock of stronger policy and strong prices?

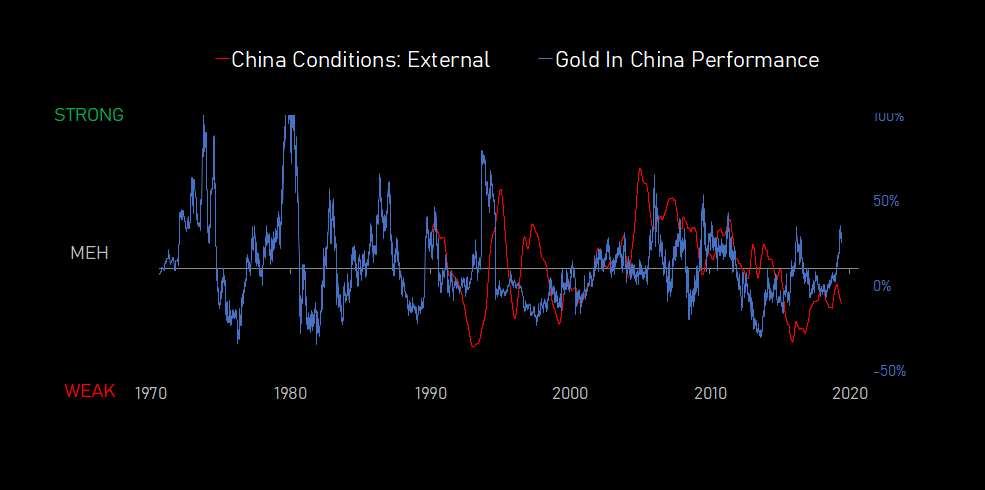

Maybe it has something to do with the external conditions China faces. Both in terms of it’s weaker trade balance, and persistent capital outflows (in spite of many controls).

Trade War probably didn’t help either…

All of which leaves us reflecting on what that means for gold in China, if and when they promise to keep the peg.

At a minimum, if you expect furrther easing (which we do), you would expect bonds in China to do well. As policymakers lower rates and expand credit, both of which flow through to higher prices on bonds.

If you’re numbers inclined, you can also look at the math. And based on the historical relationship between deteriorating conditions and higher bond prices (aka lower bond yields), you’d also be bullish Chinese bonds (in local currency terms).

So to wrap up.

Conditions in China have deteriorated.

Usually when conditions in China deteriorate, you get easing.

The kind of easing that’s good for bonds and bad for the currency.

Which leaves us wondering, how can China really promise not the let the currency go? Especially, when it looks like they are going to need some easing soon?

And if they can’t make that promise, then what’s the deal?